child tax credit october 15 2021

The child tax credit scheme was expanded to 3600 from 2000 earlier this. The next child tax credit payment will be issued on October 15 2021.

South Carolina Tax Rebates Are Coming To Eligible Taxpayers Who File Returns By October 17

The American Rescue Plan has expanded the CTC for the 2021 tax year.

. The tax credits maximum amount is 3000 per child and 3600 for children under 6. Fri October 15 2021. October 15 2021 142 PM CBS Detroit.

See what makes us different. The law requires nearly half of the credit to be sent in advance. The CTC has been revised in the following ways.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The credit tops out at 3000 for children between 6 and 17 years old. These changes will only apply for the 2021 tax year.

In terms of monthly payments families will receive their check for 300 for each child under 6 years old. Millions of families should soon receive their fourth enhanced child tax credit payment which the Internal Revenue Service distributed on Friday. Increases the tax credit amount.

A technical issue that delayed last months payments for a small number of advance child tax credit recipients in September has been fixed the IRS announced Friday as it. E-File Directly to the IRS. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

As you may know the American Rescue Plan dramatically expanded the Child Tax Credit CTC to a maximum of. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from. Families with qualifying children will receive 3000 for each child age 6 to 17 and 3600 for each child under 6.

CBS Detroit -- The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15. The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars depending on your personal situation. October 15 Deadline Approaches for Advance Child Tax Credit.

CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow. Thats an increase from the regular child tax. The 2021 CTC is different than before in 6 key ways.

Child tax credit payments worth up to 300 will be deposited from October 15 Credit. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

First families can expect some treats since the fourth round of advance monthly payments for the child tax credit are scheduled to arrive Oct. Have been a US. Ad Home of the Free Federal Tax Return.

It is worth remembering. October 14 2021 559 PM CBS Detroit. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

The IRS website provides additional information to confirm if citizens are eligible for the tax. We dont make judgments or prescribe specific policies. IR-2021-201 October 15 2021.

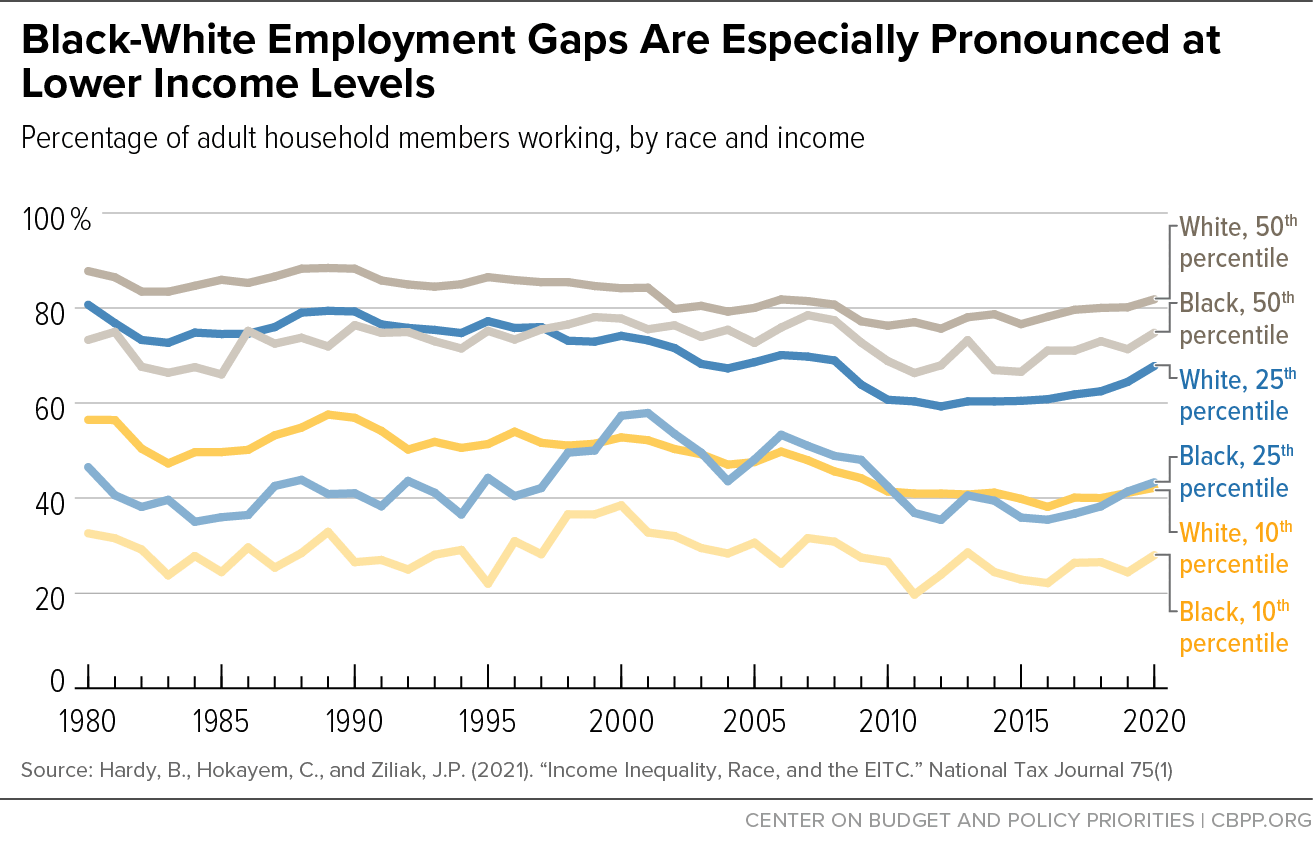

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Equitable Path Forward Webinar Series Enterprise Community Partners

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Advanced Payment Option Tas

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

What Are Marriage Penalties And Bonuses Tax Policy Center

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back